Previous Posts

- Is It Time to Buy the Homebuilders

- Credit Suisse report on the mortgage and housing i...

- Countrywide Foreclosures (REO) Blog

- View from an Unbiased Hedge Fund Manager

- 当前美国股市联想 (ZT)

- Primus Guaranty, Ltd. (PRS)

- 股民必看

- China BAK Battery (CBAK)

- 回克谈中国

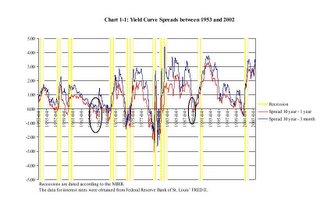

- Treasury Yield Curve

Archives

- August 2005

- December 2005

- January 2006

- February 2006

- March 2006

- April 2006

- December 2006

- January 2007

- February 2007

- March 2007

Quotes

Useful Links

- Market Watch

- Goofiz

- Stock Digest

- Blast Invest

- GuruFocus

- Investing for Beginners

- Derivative Graphic Book

- Investment Tools

- Contrarian Value Stock

- Contrarian Trader

- Insider Stock Trading

- Insider Stock Trading - By Symbol

- 股票书籍

- The Kingsland Report

Message Boards

Value Stock Pick

Tuesday, February 21, 2006

The beauty about about Reading 10 Qs (ZT)

By James60007. Chief Analyst in Goofiz.

Tue, 26 Nov 2002 13:48:04 -0600

The beauty about Reading 10 Qs is that you are always ahead of curve. For example GE We knew from after 9/11, BA has a lot less orders, so it will hurt GE engines, (This was more than 1 year ago) Utilities started downturn last year, electricity price down, utilities cut CapEx, so it will hurt GE power plant turbo engine business. When u read 10 Qs, u would see how much GE was making through different area and how those were going to hurt it. For almost 3 years, GE has no growth in sales, and it shows an enormous growth in debt. So last year when I said GE would be halved, nobody believed me. Same thing happened when I said JNPR would be 5 over Mei-gu-lun-tan 11 months ago, those people laugh at me like an idiot. I still remember when I posted " JNPR is 18 away from 5", another "smart" guy posted "MSFT is 63 away from 1" They thought it was impossible for JNPR to be 5, just like it was impossible for MSFT to be 1! I spent a lot of time in telecomm, I read JNPR 10 Qs, RBOCs 10 Qs and I read CSCO's and John Chambers was talking about gaining mkt shares from JNPR in Arizona on January 6th. Nobody listened. The only thing in front of their eyes were a few curves. Another thing is NXTL, many benefited from my call. Some like Susan Wang who never read 200 words a day was telling NXTL would go under! "cut meat" "hold to death" (Bankruptcy was the title of some media when they talked about NXTL at the time.) But if u read NXTL 10 Qs, how could that happen? Huge EBITDA, EBITDA increase sequentially, debt mature late, CapEx could be controlled, Network capacity enough to at least 12 million customers, Highest growth rate, lowest churn rate, highest profit margin, company reaffirmed. That is the beauty of reading 10 Qs! If you predicted GE correctly; if you predicted JNPR correctly; You would not be too far off with the market. So everybody, please read for your money!!

Friday, February 17, 2006

Tue, 26 Nov 2002 13:48:04 -0600

The beauty about Reading 10 Qs is that you are always ahead of curve. For example GE We knew from after 9/11, BA has a lot less orders, so it will hurt GE engines, (This was more than 1 year ago) Utilities started downturn last year, electricity price down, utilities cut CapEx, so it will hurt GE power plant turbo engine business. When u read 10 Qs, u would see how much GE was making through different area and how those were going to hurt it. For almost 3 years, GE has no growth in sales, and it shows an enormous growth in debt. So last year when I said GE would be halved, nobody believed me. Same thing happened when I said JNPR would be 5 over Mei-gu-lun-tan 11 months ago, those people laugh at me like an idiot. I still remember when I posted " JNPR is 18 away from 5", another "smart" guy posted "MSFT is 63 away from 1" They thought it was impossible for JNPR to be 5, just like it was impossible for MSFT to be 1! I spent a lot of time in telecomm, I read JNPR 10 Qs, RBOCs 10 Qs and I read CSCO's and John Chambers was talking about gaining mkt shares from JNPR in Arizona on January 6th. Nobody listened. The only thing in front of their eyes were a few curves. Another thing is NXTL, many benefited from my call. Some like Susan Wang who never read 200 words a day was telling NXTL would go under! "cut meat" "hold to death" (Bankruptcy was the title of some media when they talked about NXTL at the time.) But if u read NXTL 10 Qs, how could that happen? Huge EBITDA, EBITDA increase sequentially, debt mature late, CapEx could be controlled, Network capacity enough to at least 12 million customers, Highest growth rate, lowest churn rate, highest profit margin, company reaffirmed. That is the beauty of reading 10 Qs! If you predicted GE correctly; if you predicted JNPR correctly; You would not be too far off with the market. So everybody, please read for your money!!

Inverted Yield Curve and Recession

SwingBH's split-would-be stock investment strategy (ZT)

Remember QCOM's 1-4 split around the new millennium? That kind of gold rush time is coming again. Take JCOM as an example! The best time to load JCOM should be before its split date August 21 2003 and to unload is after that date.

Somebody may argue with me by saying: "why don't you look at the sucker EBAY?" It was a split-would-be candidate! NasdaqChina, seemingly a MM, pumped it many times. Its performance still frustrated many investors.

Why is there such a big difference? TA and FA matter. I can come up with a few rules that worked for me during the 1999-2000 tech boom.

a.It must be a growth company, especially fast growing.

b.It must be in a hot sector.

c.It must be a small or mid-cap company. As a dominant power on line, EBAY's market cap is too big. We can magine how much more $ is needed to push EBAY' s price higher as to that of JCOM.

d. No analysts bug it. Upgrades are preferred, but definitely downgrades are not a good thing.

e. The market cooperates. In other words, the market must be bullish around the split.

f. It must have a sound technical chart. Slowly moving up before split is the best. In others, price appreciation with low volume in an uptrend is the best.

g. It is better if the target stock has tradable options.

h. WHEN TO SELL? SELL ON THE FIRST DAY WHEN SPLIT IS EFFECTIVE.

BTW, if you dare to take more risk, you can buy long-term calls instead of stocks. In the winter 2004 some club members along with me successfully invested SYMC calls. It's a classical example. No pain, no gain. I wish you good luck.

Somebody may argue with me by saying: "why don't you look at the sucker EBAY?" It was a split-would-be candidate! NasdaqChina, seemingly a MM, pumped it many times. Its performance still frustrated many investors.

Why is there such a big difference? TA and FA matter. I can come up with a few rules that worked for me during the 1999-2000 tech boom.

a.It must be a growth company, especially fast growing.

b.It must be in a hot sector.

c.It must be a small or mid-cap company. As a dominant power on line, EBAY's market cap is too big. We can magine how much more $ is needed to push EBAY' s price higher as to that of JCOM.

d. No analysts bug it. Upgrades are preferred, but definitely downgrades are not a good thing.

e. The market cooperates. In other words, the market must be bullish around the split.

f. It must have a sound technical chart. Slowly moving up before split is the best. In others, price appreciation with low volume in an uptrend is the best.

g. It is better if the target stock has tradable options.

h. WHEN TO SELL? SELL ON THE FIRST DAY WHEN SPLIT IS EFFECTIVE.

BTW, if you dare to take more risk, you can buy long-term calls instead of stocks. In the winter 2004 some club members along with me successfully invested SYMC calls. It's a classical example. No pain, no gain. I wish you good luck.

SwingBH's IPO investment strategy (ZT)

Since the market becomes hot again, more and more companies would come to the market to raise money. I assume most of us don't have more than 1M assets. which means the most of us don't have access to IPOs. Don't worry, though. The good news is we can invest newly IPOed stocks.

Newly IPOed stocks are under full control by their underwriters. As a matter of fact, it's quite easy for underwriters to manipulate. Why? First, floating shares of newly IPOed stocks are few during their locking periods. Moreover, those newly IPOed stocks pretend to have sound fundamentals in order to attract investors; second, underwriters have their interests involved. They got paid commissions by cash plus profit from selling alloted stocks; third, underwriters care about their fames. If a newly IPOed stock performs weak, the chance to underwrite a next IPO is dim. For this reason, underwriters would use their fund money to buy or contract third-party funds to buy. This happened a lot back during the 1999-2000 IPO rush hour.

Not all newly IPOed stocks would perform well in the market. I successfully invested CPST, ACPW, SONS and also lost a bunch in PTIE in 2000. Like investing other stocks, TA and FA matter. The lessons I learned by putting $ and efforts can be shared with others here. Name a few:

a. Underwriters must be Wall Street monsters: Goldman Sachs (GS), Merril Lynch (ML), or Morgan Stanley (MS). As for others, piss off. I lost $ in PTIE because I didn't strictly obey the rule. I lost $40 grand in 30 minutes as a student. I still remember I almost had a heart-burn at that time.

b. It must be in a hot sector. For instance, I definitely invest an oil related stock at this point (July 2005).

c. Floating shares must be less than 20 M. The few, the better; the more, the worse. It definitely cannot be more than 100 M.

d. The first day turn-over rate must be over 100%. If it is over 100% during the first trading hour, I would definitely jump in.

e. Jump in based on its intraday technical charts (e.g. 5 minutes). Don't chase though!!!

f. Its open price on the first day must be above its IPO price. Its IPO price must be the top of its IPO price range.

g. WHEN TO SELL? SELL BEFORE ITS LOCKING EXPIRES OR WHEN UNDERWRITERS PUBLISH THEIR RATINGS (usually one month later).

etc.

No pain, no gain. Do your hard work, and you'll be rewarded.

Newly IPOed stocks are under full control by their underwriters. As a matter of fact, it's quite easy for underwriters to manipulate. Why? First, floating shares of newly IPOed stocks are few during their locking periods. Moreover, those newly IPOed stocks pretend to have sound fundamentals in order to attract investors; second, underwriters have their interests involved. They got paid commissions by cash plus profit from selling alloted stocks; third, underwriters care about their fames. If a newly IPOed stock performs weak, the chance to underwrite a next IPO is dim. For this reason, underwriters would use their fund money to buy or contract third-party funds to buy. This happened a lot back during the 1999-2000 IPO rush hour.

Not all newly IPOed stocks would perform well in the market. I successfully invested CPST, ACPW, SONS and also lost a bunch in PTIE in 2000. Like investing other stocks, TA and FA matter. The lessons I learned by putting $ and efforts can be shared with others here. Name a few:

a. Underwriters must be Wall Street monsters: Goldman Sachs (GS), Merril Lynch (ML), or Morgan Stanley (MS). As for others, piss off. I lost $ in PTIE because I didn't strictly obey the rule. I lost $40 grand in 30 minutes as a student. I still remember I almost had a heart-burn at that time.

b. It must be in a hot sector. For instance, I definitely invest an oil related stock at this point (July 2005).

c. Floating shares must be less than 20 M. The few, the better; the more, the worse. It definitely cannot be more than 100 M.

d. The first day turn-over rate must be over 100%. If it is over 100% during the first trading hour, I would definitely jump in.

e. Jump in based on its intraday technical charts (e.g. 5 minutes). Don't chase though!!!

f. Its open price on the first day must be above its IPO price. Its IPO price must be the top of its IPO price range.

g. WHEN TO SELL? SELL BEFORE ITS LOCKING EXPIRES OR WHEN UNDERWRITERS PUBLISH THEIR RATINGS (usually one month later).

etc.

No pain, no gain. Do your hard work, and you'll be rewarded.

SwingBH's penny investment strategy (ZT)

Penny stocks are referred to those whose share prices are less than $5/share. Most investors avoid penny stocks for some reasons. First, penny stocks have low-quality financials. They are more inclined to resort to bankruptcy. Apparently this is too risky. One example is MIR who filed for Chapter 11 protection this summer. I remember one reader on MITBBS stock board gambled before the announcement and harvested nothing.

Second, traditionally analysts don't follow. But I've noticed after the burst of .com bubble Wall Street has been changing. For example, an OTC BB stock I swing traded in August 2003, COVD, was rated "Buy" and given a 12-month price target $8 when it was traded less than $2/share. It finally went above $5/share.

However, there are still some investors, including fund managers, looking for gems from pennies day after day. Can you imagine how high your return could be if investing a real gem? How about the legendary Cloudice MM? She made big bucks by investing pennies.

But where and how do we find the next possible high-flier? My investment strategies may not suit you, but I'd love to share some with you here. There are several factors I wish you would take into account:

1. Turned to profitable already or predicted profitable in the near future? Good if yes;

2. Insider buying? Good if yes;

3. High volume recently? Good if yes;

4. Upgrade by analysts recently? Good if yes;

5. If not profitable yet, price/book value low, compared to peers? Good if yes;

6. Enough cash reserve to survive or low debt? Good if yes;

7. Following market trend? Good if yes;

etc.

No pain, no gain. Do your hard work, and you'll be rewarded.

Second, traditionally analysts don't follow. But I've noticed after the burst of .com bubble Wall Street has been changing. For example, an OTC BB stock I swing traded in August 2003, COVD, was rated "Buy" and given a 12-month price target $8 when it was traded less than $2/share. It finally went above $5/share.

However, there are still some investors, including fund managers, looking for gems from pennies day after day. Can you imagine how high your return could be if investing a real gem? How about the legendary Cloudice MM? She made big bucks by investing pennies.

But where and how do we find the next possible high-flier? My investment strategies may not suit you, but I'd love to share some with you here. There are several factors I wish you would take into account:

1. Turned to profitable already or predicted profitable in the near future? Good if yes;

2. Insider buying? Good if yes;

3. High volume recently? Good if yes;

4. Upgrade by analysts recently? Good if yes;

5. If not profitable yet, price/book value low, compared to peers? Good if yes;

6. Enough cash reserve to survive or low debt? Good if yes;

7. Following market trend? Good if yes;

etc.

No pain, no gain. Do your hard work, and you'll be rewarded.

SwingBH’s FA+TA based strategy for mid-term investment (ZT)

A. Why is the approach FA and TA based?

According to my research, a stock’s share price is controlled by both its fundamentals and its exteriors such as the overall market condition and investors’ sentiment. Moreover, change in fundamentals contributes to 60% fluctuation of its share price while exterior factors 40%. If we employ FA and TA approaches, we can literally use FA to capture the 60% fluctuation while TA the rest 40%. This research shows both FA and TA are important when scouring investment candidates and FA plays a more important role in a successful investment.

Considering the complexity in FA and TA, SwingBH has developed a practical and easy-to-use model for non-professionals to invest mid-term. Simply put, the model is a FA+TA based approach that consists of a few conditional checks in the areas of FA and TA, very easy to implement.

B. FA

SwingBH has chosen seven key rules that can be easily followed to find potential investment candidates. Information involved is available for free either at Yahoo Finance or MSN Money Central. By importance, each rule is given a 1-5 star rating,

1. A candidate is a good ER stock (5 stars)

By SwingBH’s definition, a good ER stock is the one that beats estimates and raises guidance in its quarterly earning report. For a conservative investor, the candidate should have been on the good ER list for at least 2 times in a row.

2. A candidate is a profitable company with positive cash flow (5 stars)

This guarantees that the target company lives on a sustainable financial fundamental without the need for further financial help in the near term. For a conservative investor, the candidate should have been profitable for at least 3 times in a row. 3 consecutive earnings is also a wall street consensus.

3.A candidate has a forwarding p/e less than industry average or SP500 average, whichever is smaller (5 stars)

It is a prerequisite that the candidate is comparatively undervalued. In this case, SwingBH is talking about forwarding p/e, not trailing p/e which has already priced. If selected after conditions 1 and 2, a target candidate may be a high growth stock other than a value type one. In this case, a Ben Graham valuation formula can be used to estimate the stock’s potential value. However, SwingBH suggests that the candidate should be avoided unless condition 3 is not applicable at all.

4. A candidate has continuous insider buying. (4 stars)

Insiders are harbingers. They know more about the candidate’s fundamentals than outsiders. Especially buying from top executives (president, CEO, CFO, CTO, COO, etc.) makes a big difference.

5. A candidate is in a favorable industry sector. (4 stars)

Market flavor changes all the time. A candidate in a favorable industry sector can easily become a market focus once it moves up to market top 10s and then get chased. In a bearish market, this condition has more significance. Stocks in such a sector become a safe harbor in a bear market.

6. A candidate has a floating share less than 100 mil. (3 stars)

The fewer the floating shares, the more volatile the candidate’s share price. In a bullish market, it means the candidate can easier outperform the overall market indexes. More risk-taken investors can narrow the number down to 40 mil or 10 mil.

7. A candidate has continuous institutional buying (3 stars)

Key institution investors include Fidelity, Vanguard, and Goldman Sachs. Institutions have more resources to conduct research than us retail investors, therefore, they’re able to spot gems a step ahead of us. However, this condition is not as important as the above others. When a candidate is highly held by institutions, there is not much room left for us to play. But at the early stage when institutions start accumulating, it’s not too late for us to jump on the train. There is another special case. It’s more valuable for a candidate not to be covered by analysts or few analysts yet.

C. TA

Since previous FA rules are based on ER and other information, a candidate that has passed through a FA background check is for a quarter investment. Looking at an intraday chart or a weekly one or a monthly one is not comparable to looking at a daily one. Looking at a variety of technical indicators is not as good as looking at price and volume because the majority of indicators are derived from the both. Three golden rules guide the search for a potential investment candidate. By the same token, each rule is given a 1-5 star rating,

1. A candidate is in an upward trend (5 stars)

An upward trend indicates the candidate is agreed upon by the market as a good object for long. A candidate’s share price should be higher than its daily ema(5) average while ema(5) is above ema(10) and ema(10) above ema(20). During a quarter window, ema(50) is not useful. Neither is ema(200).

2. A candidate’s share price is more than 80% of its 52 week high (4 stars)

If a candidate’s share price has dropped more than 20% from its 52 week high, the stock is in a bearish trend. No matter how good its fundamentals could seemingly be, there must be something wrong hidden from public investors.

3. A candidate’s daily volume has no spike after ER’s spike (4 stars)

By SwingBH’s definition, a spike refers to a volume is close to or more than historical/52 week high. A spike in volume means that the candidate gets market’s attention. It doesn’t matter a spike happens right after the candidate’s ER, which is a normal reaction by the market. It does make a difference when a spike happens for other known/unknown news than ER. It’s a good sign that a spike follows a stock price appreciation. Otherwise, it’s sign for investors to exit.

D. How is entry/exit price determined?

A candidate stock having passed a FA/TA check doesn’t mean the candidate is a 100% winner or money in the bank. Generally, the strategy to invest the candidate is buy dip and hold for a quarter or 3 months. TA should be utilized again to find entry/exit point.

1. Entry point

After ER is released, there is always time for us to load. SwingBH suggests investors should always buy dip when volumes have shrunk other than chase. This chance would emerge on the 2nd or 3rd day following ER.

Keep in mind right after the ER is not the best time. Why? First we need know market’s reaction. Do institutions and investors like the ER? This can be easily figured out by looking at that day’s volume change and price fluctuation. The best scenario is price appreciation with volume spike. The worst scenario is price depreciation with volume spike, which is a 放量阴线, indicating institutions take the chance to run away. Secondly, stock price can be too volatile for us to make a calm decision.

SwingBH suggests investors should always use limit order. A conscious investor should avoid market order. Either ema or key support levels can be as entry references. SwingBH likes ema(5) or ema(10). He also likes adding 1 more cent to a key support number, for example, if 5 is a mentally key support, SwingBH’s limit order would be placed at 5.01.

2. Exit point

When a stock’s fundamentals are changed all of a sudden (examples include warning or lowered guidance before ER, resignation of auditors or CFO, SEC investigation, losing a big customer, etc.), the stock should be unloaded at whatever price even using a market order. Any exterior factor such as a terrorist attack should not be used as a reason to sell. When a stock’s top executives kick off selling as a plotted group, the stock should be unloaded at whatever price even using a market order.

Other than the above, there are at least two possible good reasons to exit. A trailing stop is triggered or a price target is reached. Otherwise, SwingBH suggests the target stock should be held until before its next ER. Last but not least, SwingBH doesn’t suggest anybody should bet on ER unless he/she has insider information.

Saturday, February 11, 2006

According to my research, a stock’s share price is controlled by both its fundamentals and its exteriors such as the overall market condition and investors’ sentiment. Moreover, change in fundamentals contributes to 60% fluctuation of its share price while exterior factors 40%. If we employ FA and TA approaches, we can literally use FA to capture the 60% fluctuation while TA the rest 40%. This research shows both FA and TA are important when scouring investment candidates and FA plays a more important role in a successful investment.

Considering the complexity in FA and TA, SwingBH has developed a practical and easy-to-use model for non-professionals to invest mid-term. Simply put, the model is a FA+TA based approach that consists of a few conditional checks in the areas of FA and TA, very easy to implement.

B. FA

SwingBH has chosen seven key rules that can be easily followed to find potential investment candidates. Information involved is available for free either at Yahoo Finance or MSN Money Central. By importance, each rule is given a 1-5 star rating,

1. A candidate is a good ER stock (5 stars)

By SwingBH’s definition, a good ER stock is the one that beats estimates and raises guidance in its quarterly earning report. For a conservative investor, the candidate should have been on the good ER list for at least 2 times in a row.

2. A candidate is a profitable company with positive cash flow (5 stars)

This guarantees that the target company lives on a sustainable financial fundamental without the need for further financial help in the near term. For a conservative investor, the candidate should have been profitable for at least 3 times in a row. 3 consecutive earnings is also a wall street consensus.

3.A candidate has a forwarding p/e less than industry average or SP500 average, whichever is smaller (5 stars)

It is a prerequisite that the candidate is comparatively undervalued. In this case, SwingBH is talking about forwarding p/e, not trailing p/e which has already priced. If selected after conditions 1 and 2, a target candidate may be a high growth stock other than a value type one. In this case, a Ben Graham valuation formula can be used to estimate the stock’s potential value. However, SwingBH suggests that the candidate should be avoided unless condition 3 is not applicable at all.

4. A candidate has continuous insider buying. (4 stars)

Insiders are harbingers. They know more about the candidate’s fundamentals than outsiders. Especially buying from top executives (president, CEO, CFO, CTO, COO, etc.) makes a big difference.

5. A candidate is in a favorable industry sector. (4 stars)

Market flavor changes all the time. A candidate in a favorable industry sector can easily become a market focus once it moves up to market top 10s and then get chased. In a bearish market, this condition has more significance. Stocks in such a sector become a safe harbor in a bear market.

6. A candidate has a floating share less than 100 mil. (3 stars)

The fewer the floating shares, the more volatile the candidate’s share price. In a bullish market, it means the candidate can easier outperform the overall market indexes. More risk-taken investors can narrow the number down to 40 mil or 10 mil.

7. A candidate has continuous institutional buying (3 stars)

Key institution investors include Fidelity, Vanguard, and Goldman Sachs. Institutions have more resources to conduct research than us retail investors, therefore, they’re able to spot gems a step ahead of us. However, this condition is not as important as the above others. When a candidate is highly held by institutions, there is not much room left for us to play. But at the early stage when institutions start accumulating, it’s not too late for us to jump on the train. There is another special case. It’s more valuable for a candidate not to be covered by analysts or few analysts yet.

C. TA

Since previous FA rules are based on ER and other information, a candidate that has passed through a FA background check is for a quarter investment. Looking at an intraday chart or a weekly one or a monthly one is not comparable to looking at a daily one. Looking at a variety of technical indicators is not as good as looking at price and volume because the majority of indicators are derived from the both. Three golden rules guide the search for a potential investment candidate. By the same token, each rule is given a 1-5 star rating,

1. A candidate is in an upward trend (5 stars)

An upward trend indicates the candidate is agreed upon by the market as a good object for long. A candidate’s share price should be higher than its daily ema(5) average while ema(5) is above ema(10) and ema(10) above ema(20). During a quarter window, ema(50) is not useful. Neither is ema(200).

2. A candidate’s share price is more than 80% of its 52 week high (4 stars)

If a candidate’s share price has dropped more than 20% from its 52 week high, the stock is in a bearish trend. No matter how good its fundamentals could seemingly be, there must be something wrong hidden from public investors.

3. A candidate’s daily volume has no spike after ER’s spike (4 stars)

By SwingBH’s definition, a spike refers to a volume is close to or more than historical/52 week high. A spike in volume means that the candidate gets market’s attention. It doesn’t matter a spike happens right after the candidate’s ER, which is a normal reaction by the market. It does make a difference when a spike happens for other known/unknown news than ER. It’s a good sign that a spike follows a stock price appreciation. Otherwise, it’s sign for investors to exit.

D. How is entry/exit price determined?

A candidate stock having passed a FA/TA check doesn’t mean the candidate is a 100% winner or money in the bank. Generally, the strategy to invest the candidate is buy dip and hold for a quarter or 3 months. TA should be utilized again to find entry/exit point.

1. Entry point

After ER is released, there is always time for us to load. SwingBH suggests investors should always buy dip when volumes have shrunk other than chase. This chance would emerge on the 2nd or 3rd day following ER.

Keep in mind right after the ER is not the best time. Why? First we need know market’s reaction. Do institutions and investors like the ER? This can be easily figured out by looking at that day’s volume change and price fluctuation. The best scenario is price appreciation with volume spike. The worst scenario is price depreciation with volume spike, which is a 放量阴线, indicating institutions take the chance to run away. Secondly, stock price can be too volatile for us to make a calm decision.

SwingBH suggests investors should always use limit order. A conscious investor should avoid market order. Either ema or key support levels can be as entry references. SwingBH likes ema(5) or ema(10). He also likes adding 1 more cent to a key support number, for example, if 5 is a mentally key support, SwingBH’s limit order would be placed at 5.01.

2. Exit point

When a stock’s fundamentals are changed all of a sudden (examples include warning or lowered guidance before ER, resignation of auditors or CFO, SEC investigation, losing a big customer, etc.), the stock should be unloaded at whatever price even using a market order. Any exterior factor such as a terrorist attack should not be used as a reason to sell. When a stock’s top executives kick off selling as a plotted group, the stock should be unloaded at whatever price even using a market order.

Other than the above, there are at least two possible good reasons to exit. A trailing stop is triggered or a price target is reached. Otherwise, SwingBH suggests the target stock should be held until before its next ER. Last but not least, SwingBH doesn’t suggest anybody should bet on ER unless he/she has insider information.

Creative Technology Ltd. (CREAF)

The question is, will Creative Zen Vision:M be a big sale and is CREAF undervalued?

Well, it won't be as spectacular as iPod for sure. But technically, Creative's new product is reviewed as SUPERIOR than iPod's video and many technical reviewers recognize this. Hopefully user would start to follow. Unfornately, Creative lacks its strategy in marketing and fostering a hip-hop culture as that of Apple. On the flip side, it has been significantly ignored in the financial market and we probably have no further downside from here.

Where do I get to know the new Vision:M? From a article in CNET which list ten "cool gadgets" you should have.

PC Magazine Review

CNET Review

Here's the excerpt of a review from a Fatwalleter,

"Unless you have seen the ZVM in person and have compared it side by side to a 5G Ipod, don't nay say.

I personally own a ZVM and I have compared it directly to my friend's 5g Ipod (I actually waited for the ZVM release before making a decision between the two).

Let me tell you the added thickness helps in terms of it being much easier to hold. The 5G feels more clumsy in the hand.

The ZVM has a better battery life. The 5G's 2 hours of video playback is pathetic.

The video is amazing on the ZVM and while it is a tad bit oversaturated, it looks way better than the undersaturated 5G screen. In addition it plays many codecs that the Ipod does not support including my favorites xvid, divx and avi. It is perfect for the movies I dl from the internet.

The ZVM GUI is very user friendly.

The ZVM has a built in FM radio.

The ZVM has a user customizable eq.

I hope after all this you don't make me out as an Apple hater. I love the Ipod too but it fall short in several areas for me including lack of codec support, lackluster video playback and no user customizable eq.

If you guys are interested in dap discussions I suggest you go to www.dapreview.net

"

For a comparison of video quality between Vision:M and iPod Video. Vision:M is to the left.

Wednesday, February 08, 2006

Well, it won't be as spectacular as iPod for sure. But technically, Creative's new product is reviewed as SUPERIOR than iPod's video and many technical reviewers recognize this. Hopefully user would start to follow. Unfornately, Creative lacks its strategy in marketing and fostering a hip-hop culture as that of Apple. On the flip side, it has been significantly ignored in the financial market and we probably have no further downside from here.

Where do I get to know the new Vision:M? From a article in CNET which list ten "cool gadgets" you should have.

PC Magazine Review

CNET Review

Here's the excerpt of a review from a Fatwalleter,

"Unless you have seen the ZVM in person and have compared it side by side to a 5G Ipod, don't nay say.

I personally own a ZVM and I have compared it directly to my friend's 5g Ipod (I actually waited for the ZVM release before making a decision between the two).

Let me tell you the added thickness helps in terms of it being much easier to hold. The 5G feels more clumsy in the hand.

The ZVM has a better battery life. The 5G's 2 hours of video playback is pathetic.

The video is amazing on the ZVM and while it is a tad bit oversaturated, it looks way better than the undersaturated 5G screen. In addition it plays many codecs that the Ipod does not support including my favorites xvid, divx and avi. It is perfect for the movies I dl from the internet.

The ZVM GUI is very user friendly.

The ZVM has a built in FM radio.

The ZVM has a user customizable eq.

I hope after all this you don't make me out as an Apple hater. I love the Ipod too but it fall short in several areas for me including lack of codec support, lackluster video playback and no user customizable eq.

If you guys are interested in dap discussions I suggest you go to www.dapreview.net

"

For a comparison of video quality between Vision:M and iPod Video. Vision:M is to the left.

Mamma.com Inc. (MAMA)

In 2002, we learned about a new auto theft deterrent called "Lo Jack". The working mechanism was that a wireless device was installed somewhere in your car. In the case that the car is stolen, the constant signal emitted by such device would notify the cop instantly. Recovery of the vehicles equipped with Lo Jack thus are significantly improved. Many peopel wowed it as the only REAL effective way against auto theft. Since then, the stock has surged from 4 dollars to over 20 dollars today. I still regret not paying attention to its stock even by knowing such an revolutionary invention.

Lessons learned: pay attention to good products around you. Something you know make sense make sense to a lot of other people as well.

Recently I just found a relly neat piece of software to search items on my desktop. Google's desktop search received much publicity but it isn't nearly as neat as this software. Later I learned the company, Copernic, has been purchased by Mamma.Com Inc. (MAMA). I visited mamma.com and well, there's no big deal. The company is a search engine of the search engines. I don't know how much marginal benefits it provide with the abundant existence of the search engines. If Google and Yahoo are the stocks, this site is more like a mutual fund. If holding the invidual stocks themselves can provide you with stable return and steady dividends, why bother to buy the mutual fund with extra overhead? That probably the reason why its stock hasn't been good at all.

But by enabling Copernic probably it has a new edge in the crowd. I can't yet tell where the profitability comes from, but I have a feeling that it would gain traction in visits and usages. For a small company of its size, you don't need to beat Google or Yahoo in every aspect. You just need to focus on some area and do it really well, and the market would reward you.

There's little information financially. The latest available from Nasdaq are the reports from 2004. The key statistics aren't bad at all. With about 23.88 million cash in hand, total cash per share alone is 1.996, compared to the stock price of 2.88 today. Current ratio is 9.97 and debt/equity ratio is 0 (??? don't think this is correct though). Profitability is still an issue, but all the statistics show significant improvement over the dot com bubble era.

Lessons learned: pay attention to good products around you. Something you know make sense make sense to a lot of other people as well.

Recently I just found a relly neat piece of software to search items on my desktop. Google's desktop search received much publicity but it isn't nearly as neat as this software. Later I learned the company, Copernic, has been purchased by Mamma.Com Inc. (MAMA). I visited mamma.com and well, there's no big deal. The company is a search engine of the search engines. I don't know how much marginal benefits it provide with the abundant existence of the search engines. If Google and Yahoo are the stocks, this site is more like a mutual fund. If holding the invidual stocks themselves can provide you with stable return and steady dividends, why bother to buy the mutual fund with extra overhead? That probably the reason why its stock hasn't been good at all.

But by enabling Copernic probably it has a new edge in the crowd. I can't yet tell where the profitability comes from, but I have a feeling that it would gain traction in visits and usages. For a small company of its size, you don't need to beat Google or Yahoo in every aspect. You just need to focus on some area and do it really well, and the market would reward you.

There's little information financially. The latest available from Nasdaq are the reports from 2004. The key statistics aren't bad at all. With about 23.88 million cash in hand, total cash per share alone is 1.996, compared to the stock price of 2.88 today. Current ratio is 9.97 and debt/equity ratio is 0 (??? don't think this is correct though). Profitability is still an issue, but all the statistics show significant improvement over the dot com bubble era.